why?

This blog details the attempt to purchase a boat from a shipyard.

I am an independent sailor and was involved in the technical and marine assessment of the vessel.

It highlights that, as in life, the trust we place in machines should not be confused with the trust we place in the people involved.

Purchasing a boat from a shipyard can present unique challenges. Buying a used boat is typically straightforward when following international standards such as those set by MYBA. However, shipyard commitments are primarily secured by the reputation of the shipyard itself. Is it enough?

There was a boat for sale

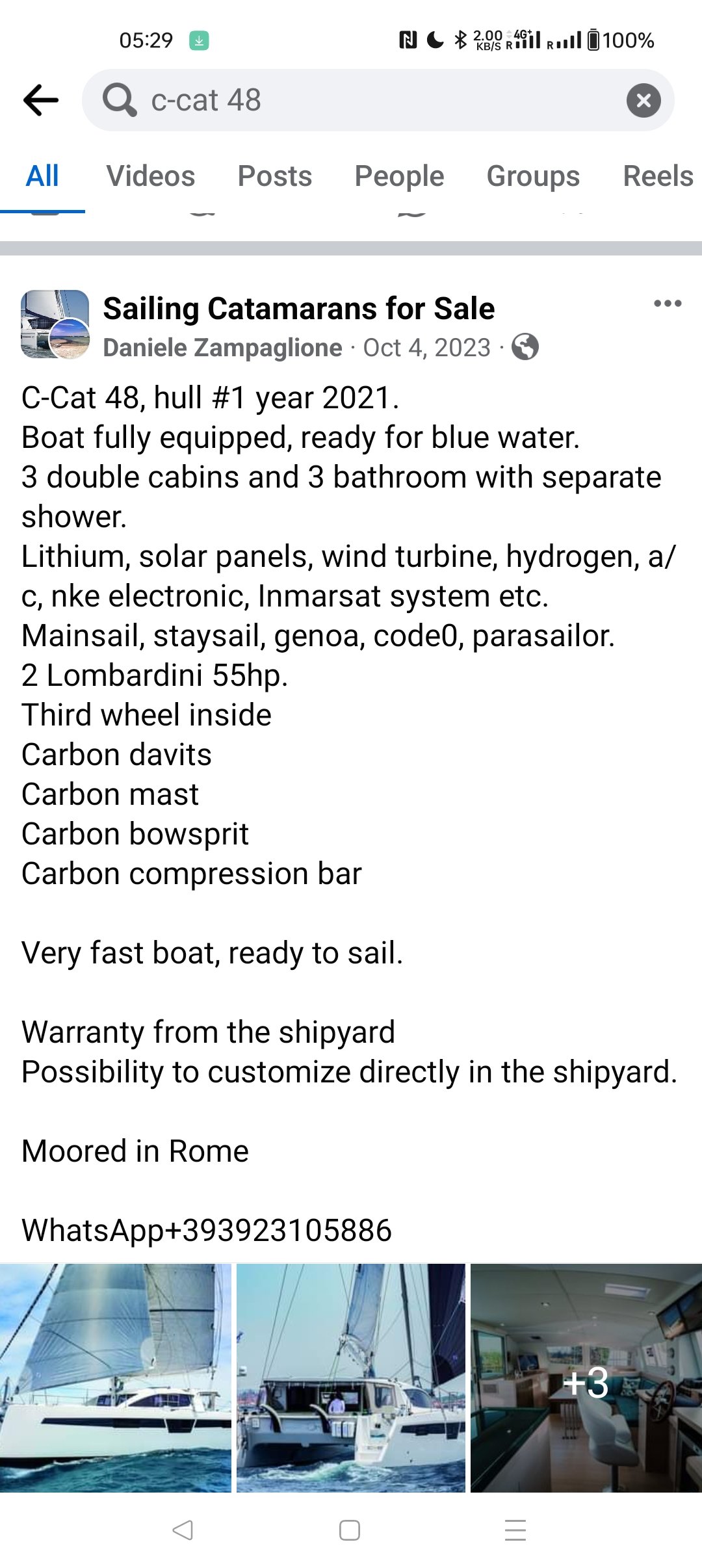

The C-Cat 48, manufactured by Comar / C-Catamarans in Rome, is a performance-oriented catamaran. Hull #1, named Anator, primarily served as the demonstration model. On October 4, 2023, Comar’s Marketing Director, Daniel Daniele Zampaglione, listed the boat for sale directly from the shipyard. The sale included complete refitting and a shipyard warranty.

The interested buyer engaged in detailed discussions with the shipyard, collected relevant materials, and dispatched an experienced captain and catamaran sailor to assess the boat and factory. The expert compiled the initial inventory list. Negotiations led to a Memorandum of Understanding (MOU) between the seller (C-catamaran/Comar) and the buyer, specifying the boat’s price (VAT paid, free of debt and liens), refitting scope, and warranty terms. As a condition for proceeding, the shipyard required a 5% refundable deposit to demonstrate commitment.

Following the confirmed offer/MOU execution, the buyer enlisted a certified Italian surveyor. The shipyard coordinated lift-up and in-water surveys, including a sea trial. The survey took place in the presence of the shipyard’s sales manager, production engineer, the buyer’s appointed expert, and the Italian Surveyor.

The survey was mostly successful showing normal issues which can be fixed. The survey was not completed due to missing navigation systems (the implication was that the radar and most integrations could not be tested). After compiling the findings, the buyer presented the shipyard list of issues. Parties conducted negotiations in December 2023 (when the shipyard was not on holiday). The focus was the shipyard’s requests to eliminate or reduce certain systems or components. The buyer was flexible and managed to settle most of the gaps.

The Deal

In the phase of formulating the sales agreement, the shipyard did not provide a version. The buyer took it upon himself to propose a draft. The buyer requested the necessary legal documents, and his lawyer presented the first draft in January. In response, the shipyard required changes, including:

- Changing the seller to an unknown Italian company.

- The shipyard could not present a clear title since the boat was mortgaged to a financing company.

- The shipyard requested the buyer to pay in advance in their stead the full leasing amount. This amounted to over 35% of the boat’s value.

- the shipyard refused to be a party in the agreement although in the MOU it was the appointed seller.

- The seller rejected the buyer´s offer to use common industry agreements such as the MYBA agreement and escrow, insisting on Italian law.

- During the futile discussions in January 2023, he shipyard stated it was consulting external parties but did not propose a revised transaction structure that would have enabled safe execution according to Italian law and regulations.

- Contrary to the explicit presentations when offering the boat and the signed MOU, the shipyard withdrew from the “as new” refit or even maintaining the components that required regulatory inspection.

- These terms of payment would have meant that there wouldn´t be:

- Clean title handed to the buyer or trustee

- Commitment to finalizing the process in defined timelines.

- Solid guarantees. (The shipyard refused to guarantee payments, execution, or its obligations in the Memorandum of Understanding.).

To facilitate the deal, the buyer suggested several solutions, but none were accommodated:

- Appointing an escrow agent to hold the funds and supervise the transaction, payments, deregistration, and delivery.

- Arrange with the financing company for the buyer to pay them directly in exchange for a clear title.

- Providing a guarantee by the shipyard (which in retrospect would have been ill-advised).

The Failure

Throughout February, The shipyard did not respond to communications during this period.. At the end of February, the buyer, having incurred significant losses in terms of time, travel expenses, and expert and legal fees, requested a clear and immediate answer regarding whether the shipyard could fulfil its obligations.

At the beginning of March, the shipyard notified the buyer that they had cancelled the deal due to the buyer’s “lack of trust” and promised to return the deposit within three days. Thereon, the communications were irrelevant and did not lead to any resolution.

Since the end of April 2023, The shipyard did not respond to communications during this period and never returned the deposit

| Date | Event |

|---|---|

| 4-10-2023 | C-CAT 48 #1 C-CATAMARANS ADVERT |

| 6-10-2023 | Buyer inquiry |

| 16-10-2023 | ON-SITE ASSESSMENT AND SHIPYARD VISIT |

| 23/24-10-2023 | DISCUSSING THE DEAL FLOW |

| 4/11/23 | OFFER ACCEPTED AND SIGNED BY THE PARTIES (MOU) |

| 7/11/23 | RECEIPT OF 42,000 EUR BY C-CATAMARANS |

| 17/11/23 | APPOINTMENT OF BUYER´S SURVEYOR |

| 17/11/23 | SHIPYARD COORDINATE SURVEY HAUL-UP TO 25-11-2023 |

| 25-11-2023 | SURVEY HAUL-UP (TO DRY THE HULL) |

| 29-11-2023 | SURVEY AND SEA TRIAL |

| 10-12-2023 | DISCUSSIONS WITH THE SHIPYARD REGARDING THE MISSING NAVIGATION SYSTEM AND REDUCED SCOPE OF MAINTENANCE AND INVENTORY |

| 11-12-2023 TILL 30-12-2023 | BUYER LAWYER PREPARES DRAFT SALE AGREEMENT |

| 2-1-2024 TILL 12-1-2024 | BUYER AND SELLER TRY TO RESOLVE THE KEY DISAGREEMENTS AND SELLER CLAIMS TO ARRANGE ACCEPTABLE MECHANISM |

| 13-1-24 TILL 31-1-24 | THE SELLER TERMINATES THE DEAL AND PROMISE TO RETURN DEPOSIT |

| 1-2-2024 TILL 9-2-2024 | SELLER CLAIMS TO CHECK POSSIBILITIES WITH LEASING COMPANY AND LAWYERS WITH NO RESULT |

| 10-2-2024 TILL 28-2-2024 | SELLER AVOIDS MEANINGFUL COMMUNICATION |

| 28-2-2024 | BUYER DEMAND DEFINITE ANSWER WHETHER SELLER CAN FULFIL HIS UNDERTAKINGS |

| 11-3-2024 | Repeated Demands to return the funds |

| March 2024 | irrelevant info and continuous delays by Comar |

| 13-4-2023 | Repeated Demands to return the funds |

| 11-5-2024 | Official claim to return the funds |

| January 2025 | letters of claim to C-Catamarans were not answered. Legal proceedings were opened |

| 27-3-2025 | the Court of Rome ordered C- Catamarans S.r.l. to pay Euro 42.000,00 as capital (plus interests, Euro 1.305 for legal fees, Euro 286,00 for legal costs and VAT) |

Privacy Statement

At Notice2Sailors, we are committed to protecting your privacy. We only use cookies for technical purposes, ensuring that your browsing experience is smooth and secure. We do not collect any personal data without your consent.

For any inquiries or concerns regarding our privacy practices, please contact us at info@notice2sailors.com.

(C) andorra 2024

GDPR disclaimer

Under the General Data Protection Regulation (GDPR), quoting the name of a person representing a company in an online publication is generally allowed, but certain conditions and considerations must be met:

- Legitimate Interest: You need to establish a legitimate interest for processing and publishing the person’s name. If the individual is a public figure, such as a company representative or executive, and the information is relevant to the public or professional context, this might be considered a legitimate interest.

- Transparency: Ensure that the publication is transparent about why and how personal data is being used. It’s a good practice to include a privacy notice explaining the data processing activities.

- Data Minimization: Only use the personal data that is necessary. Avoid including unnecessary personal details.

- Consent: While consent is not always required if legitimate interest can be established, obtaining consent from the individual can provide an additional layer of compliance and clarity.

- Data Subject Rights: The individual has rights under the GDPR, including the right to access, rectify, and in some cases, object to the processing of their personal data. Ensure that mechanisms are in place to address these rights.

- Context: The context in which the person’s name is quoted matters. If the person is acting in their professional capacity and the information is related to their role within the company, it is generally more acceptable than if the information pertains to their private life.

In summary, while GDPR does allow quoting the name of a person representing a company in an online publication, it is crucial to ensure that the publication aligns with GDPR principles, particularly around legitimate interest, transparency, data minimization, and respect for the individual’s data protection rights.

Legitimate interest is one of the six lawful bases for processing personal data under the GDPR. It allows organizations to process personal data without obtaining consent, provided that the processing is necessary for the purposes of the legitimate interests pursued by the data controller or by a third party, and that these interests are not overridden by the fundamental rights and freedoms of the data subject.

Here’s a detailed breakdown of what constitutes legitimate interest:

- Purpose Test: The organization must identify a legitimate interest, which could include commercial interests, individual interests, or broader societal benefits. For instance, direct marketing, fraud prevention, or ensuring network security might be considered legitimate interests.

- Necessity Test: The processing must be necessary to achieve the identified legitimate interest. If the same result can reasonably be achieved in a less intrusive way, then this test may not be met.

- Balancing Test: The organization must balance its legitimate interest against the data subject’s interests, rights, and freedoms. This involves considering the nature of the personal data, the context in which it is processed, and the impact on the data subject. If the data subject’s rights and interests override the legitimate interest, the processing cannot be justified on this basis.

(c) 2024 Notice 2 Sailors, AD 2024